Move goods, not due dates.

For logistics companies, speed is everything—until payments slow you down. OCTA helps you automate invoicing, follow-ups, and collections, so your cash flow keeps up with your cargo.

Used by forward-thinking teams

Why OCTA for Logistics?

Stay on schedule, streamline AR, and keep cash flow moving—without the manual mess.

Follow-Ups That Run Themselves

Stop chasing down payments. Smart reminders keep your collections on autopilot.

Scale Without the Stress

Whether you handle 5 shipments or 5,000—OCTA grows with you.

Real-Time Visibility

Know what’s paid, what’s pending, and what needs attention. No surprises, just clarity.

Everything You Need to Optimize AR

Free eSignatures

Send contracts, invoices, and get signatures

Smart Invoicing

Create and send customized invoices in seconds.

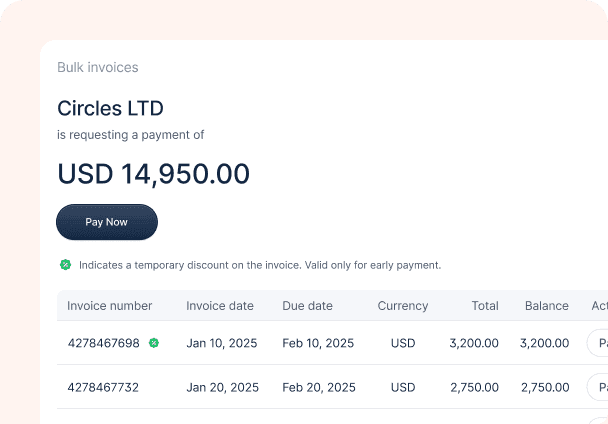

Bulk Invoicing

Too many shipments? Process multiple invoices in clicks.

Automated Follow-Ups

No more “Just checking in” emails. Ever.

Why OCTA?

Contract to Cash, in One Flow

From signed deals to settled invoices—automate every step

Save Hours Every Week

Your finance team spends less time chasing payments.

Get Paid Without the Ping-Pong

No more back-and-forth. Just smooth, predictable payments

Run Global, Stay Local

Invoice and collect in multiple currencies, with payment options.

Real-Time Visibility

Track every invoice, reminder, and payment status from one dashboard

AI That Thinks Like a CFO

OCTA predicts late payments, optimizes follow-ups, and keeps your cash flow running.

Customer Stories

Hear from finance professionals like you using OCTA

Maram

COO, Moneyhash

“Before OCTA, manual invoicing, complex usage-based billing, and reliance on wire transfers slowed our AR process.”

Nabil

VP Finance

“OCTA streamlined our AR processes, automating workflows and improving payment efficiency.”

They have more to say...

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."

"As a lean team, we needed something that would scale with us. OCTA automated our follow-ups, improved our cash collection, and saved us from hiring too early. We’re collecting faster, with less effort."

OCTA helped us completely rethink our AR workflow. We shifted 55% of our customers from manual bank transfers to autocharge, transforming payments from a push to a pull process. The result? Predictable cash flow, fewer hours wasted on follow-ups, and a team that's now focused on growth instead of chasing invoices. It's not just about efficiency — it's about control.

OCTA has completely transformed our finance operations — from contract creation to cash collection, everything is automated and fully connected. We've eliminated manual work, accelerated our cash flow, and gained real-time visibility across systems. Moving from fragmented tools to a unified process has given us total control over our revenue operations. It’s a game changer for scaling with confidence.

When renewals slowed down, OCTA’s invoice financing kept our cash flow steady and our operations moving. Instead of waiting on delayed payments, we unlocked capital tied up in outstanding invoices. OCTA gave us the flexibility to bridge the gap and focus on growth, even during the tough cycles.

OCTA enabled us to streamline B2B payment collection, making it easy for our clients to pay across regions. With access to the best-in-market processing rates, we’ve reduced our transaction costs significantly. Plus, OCTA’s support team has been a true partner — proactive, responsive, and always ready to help us optimise further.

OCTA has become the backbone of our AR services, allowing us to scale confidently as we grow our client base. With automation handling invoicing, payments, and reconciliation, we can serve more customers without adding headcount. OCTA gives us the efficiency and control to expand our AR offering at speed.

With OCTA, we’re saving over 90 hours a month and cutting $4,200 in monthly staffing costs — all while reducing our DSO by 35%. The team has shifted from manual collections to focusing on growth, knowing our AR is running on autopilot.

"OCTA feels like a true partner. The team listens, ships fast, and has delivered every feature we’ve needed—from PDF invoice reminders to embedded financing. We’ve built our AR process around them, and it’s working beautifully."