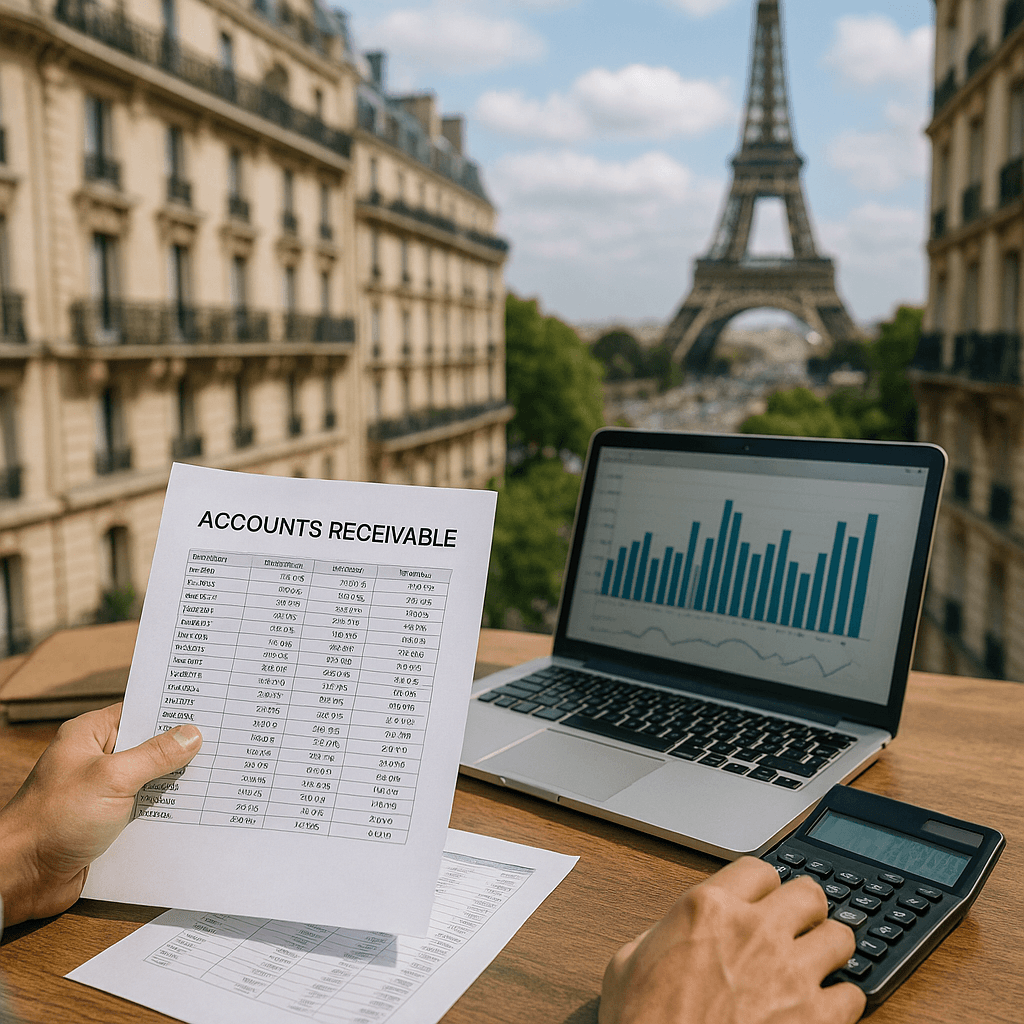

Optimizing Accounts Receivables for Small Businesses in Paris

Managing accounts receivables can be a challenging task for small businesses in Paris. It is crucial to balance timely payments from clients while maintaining positive relationships. Here, we explore key strategies to optimize accounts receivables for small businesses in Paris.

One of the major challenges faced by small businesses in Paris is the delay in receiving payments, leading to cash flow issues. Additionally, tracking and following up on outstanding invoices can be time-consuming.

Challenges Faced by Small Businesses in Paris

- Delayed payments impacting cash flow

- Time-consuming invoice tracking and follow-up

Optimizing Accounts Receivables: Solutions and Strategies

Implementing the following strategies can help small businesses in Paris streamline their accounts receivables processes:

- Invoice Automation: Utilize accounting software to automate the invoicing process, ensuring prompt delivery and tracking of invoices.

- Clear Payment Terms: Clearly outline payment terms on invoices to avoid confusion and delays in payments.

- Offer Incentives: Encourage early payments by providing discounts or incentives for prompt settlements.

Implementation Steps

- Choose a reliable accounting software that offers invoicing automation features.

- Review and update payment terms on existing invoices to make them more transparent.

- Communicate incentive programs for early payments to clients via email or phone calls.

By following these strategies and implementing the suggested steps, small businesses in Paris can effectively manage their accounts receivables and improve cash flow.

Optimizing accounts receivables is essential for the financial health of small businesses. Take proactive steps today to enhance your cash flow management and ensure timely payments.