AFI Capital Partners

AFI Capital Partners is a venture capital firm that specializes in investing in early-stage technology companies with high growth potential. Their core investment strategy involves providing capital, strategic guidance, and industry expertise to help entrepreneurs succeed. Insights from aficapitalpartners.com indicate a focus on disruptive technologies, innovative business models, and market-leading companies, which align with their goal of maximizing returns for their investors while supporting the growth of their portfolio companies. This third-party data could help AFI Capital Partners make more informed investment decisions

Austin, United States

Seed, Series A, Series B

$1M–$5M

Venture Fund

Cannabis, Manufacturing, SaaS, Telecommunications (TMT)

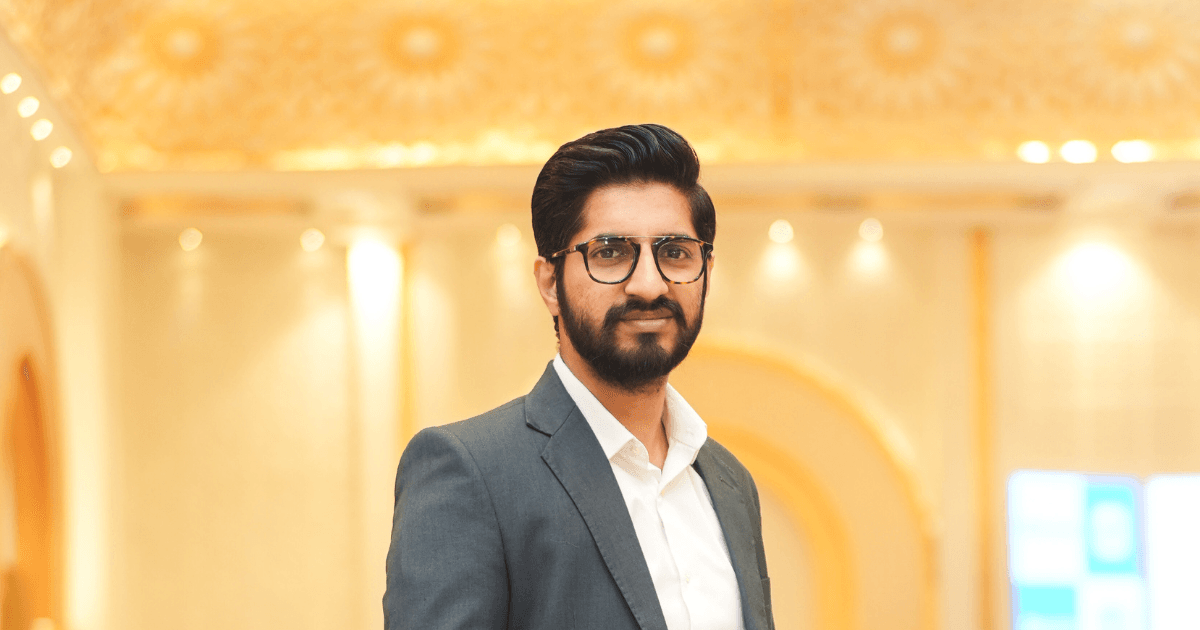

Nicolas Richardson

About AFI Capital Partners

AFI Capital Partners, led by a team of seasoned venture capitalists, is a premier venture capital firm specializing in early-stage tech investments. With a laser focus on disruptive technologies and market-leading companies, AFI Capital Partners provides not only capital but also strategic guidance and industry expertise to help startups succeed. Their hands-on approach to investing ensures that portfolio companies have the resources and support they need to scale and thrive in the competitive tech landscape.

Their portfolio boasts a mix of high-potential tech startups across various sectors, including SaaS, fintech, artificial intelligence, and cybersecurity. AFI Capital Partners' fund focus is on identifying innovative technologies and teams with the potential for rapid growth and market dominance. The firm typically invests in companies at the seed and Series A stages, providing ticket sizes ranging from $500,000 to $5 million to help fuel their growth and expansion. With a track record of success and a keen eye for emerging trends, AFI Capital Partners is a sought-after partner for tech entrepreneurs looking to take their startups to the next level.

For questions or updates to your page, reach out to us here.