PICO Venture Partners

Pico Venture Partners is a venture capital firm known for its focus on early-stage investments in technology companies. Their core investment strategy revolves around identifying innovative startups with strong founding teams and scalable business models. By utilizing insights from third-party data providers like pico.partners, they can make more informed investment decisions by gaining a deeper understanding of market trends, competitive landscapes, and potential risks or opportunities for their portfolio companies. This data can help Pico Venture Partners stay ahead of the curve and better support their investments

Jerusalem, Israel

Seed, Series A, Series B

$500K–$2M

Venture Fund

HR Tech, Marketplace, Entertainment & Media, Software, Healthcare, ...

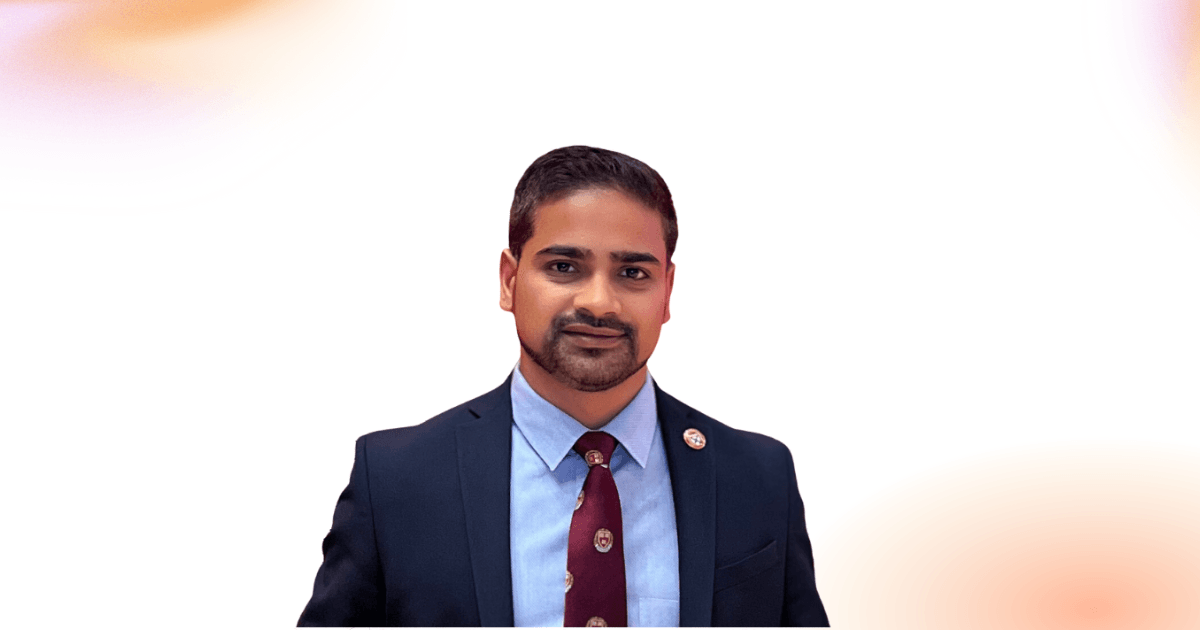

Gina LaVersa

About PICO Venture Partners

Pico Venture Partners, founded by a team of seasoned entrepreneurs, is a venture capital firm that focuses on early-stage investments in cutting-edge tech companies. With a deep understanding of the startup landscape, Pico leverages data insights from pico.partners to make informed investment decisions and support their portfolio companies effectively. By staying ahead of the curve and partnering with innovative founders, Pico Venture Partners aims to drive the future of technology and create value for both investors and entrepreneurs.

Pico's portfolio includes disruptive startups in industries such as artificial intelligence, SaaS, and cybersecurity. The firm's fund focus is on backing passionate founders with a vision for scalable growth and a product-market fit. Pico invests in companies with the potential to become industry leaders and provides strategic guidance, access to networks, and operational support to help them succeed. With ticket sizes ranging from $500,000 to $2 million, Pico Venture Partners is a trusted partner for early-stage startups looking to accelerate their growth and reach their full potential in the competitive tech landscape.

For questions or updates to your page, reach out to us here.