Ripple

Ripple is a venture capital firm that specializes in investing in early-stage technology companies with a focus on financial technology and blockchain solutions. Their core investment strategy involves identifying disruptive technologies and supporting portfolio companies through strategic partnerships and operational expertise. The insights from their website, such as case studies highlighting successful investments and testimonials from founders, demonstrate their commitment to nurturing innovative startups and driving growth within their portfolio. Third-party data, such as industry trends and market analysis, could help Ripple make more informed investment decisions and provide valuable

San Francisco, United States

Seed, Series A, Series B

$50K–$10M

Venture Fund

Cryptocurrency / Blockchain, FinTech, Information Technology

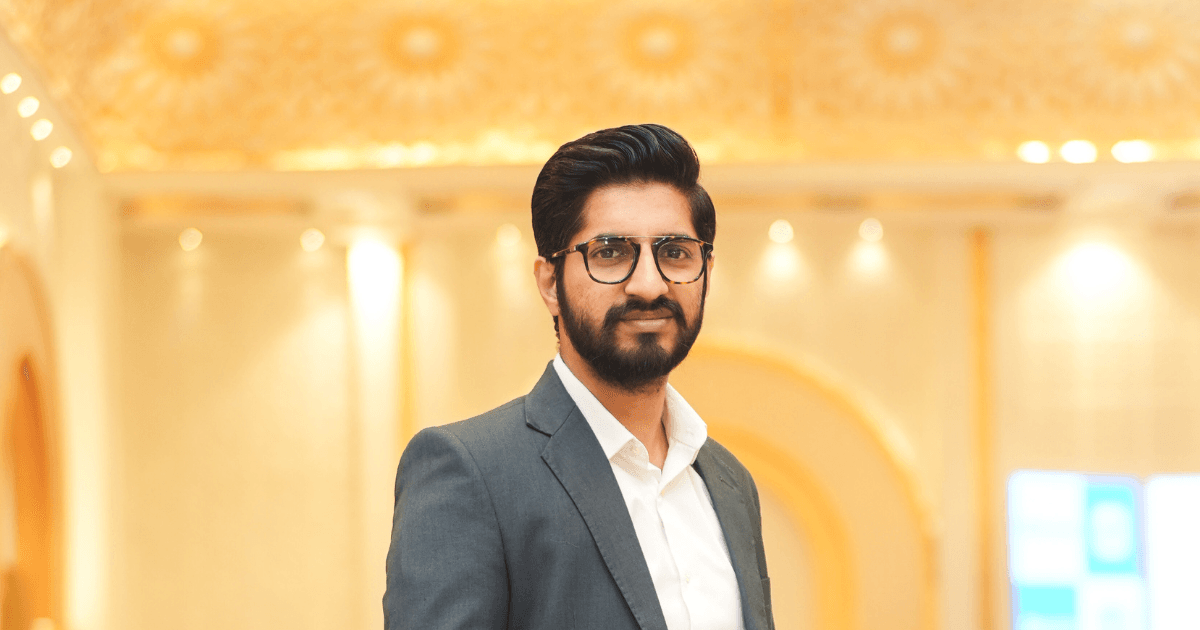

Bernard Ginalski

About Ripple

Ripple is a Silicon Valley-based venture capital firm specializing in early-stage investments in the financial technology and blockchain sectors. With a keen eye for disruptive technologies, Ripple seeks out innovative startups that have the potential to revolutionize the industry. Through strategic partnerships and operational expertise, they help portfolio companies navigate the complex startup landscape and scale their businesses effectively.

Ripple's portfolio includes a diverse range of companies, from blockchain payment solutions to digital asset management platforms. Their fund focus is on companies that are leveraging cutting-edge technologies to disrupt traditional finance and drive innovation in the industry. With ticket sizes typically ranging from $500,000 to $5 million, Ripple plays a crucial role in fueling the growth and success of pioneering startups in the fast-evolving fintech and blockchain sectors. Through rigorous due diligence and partnership-building, Ripple aims to support the next generation of groundbreaking companies and drive positive change in the financial technology landscape.

For questions or updates to your page, reach out to us here.